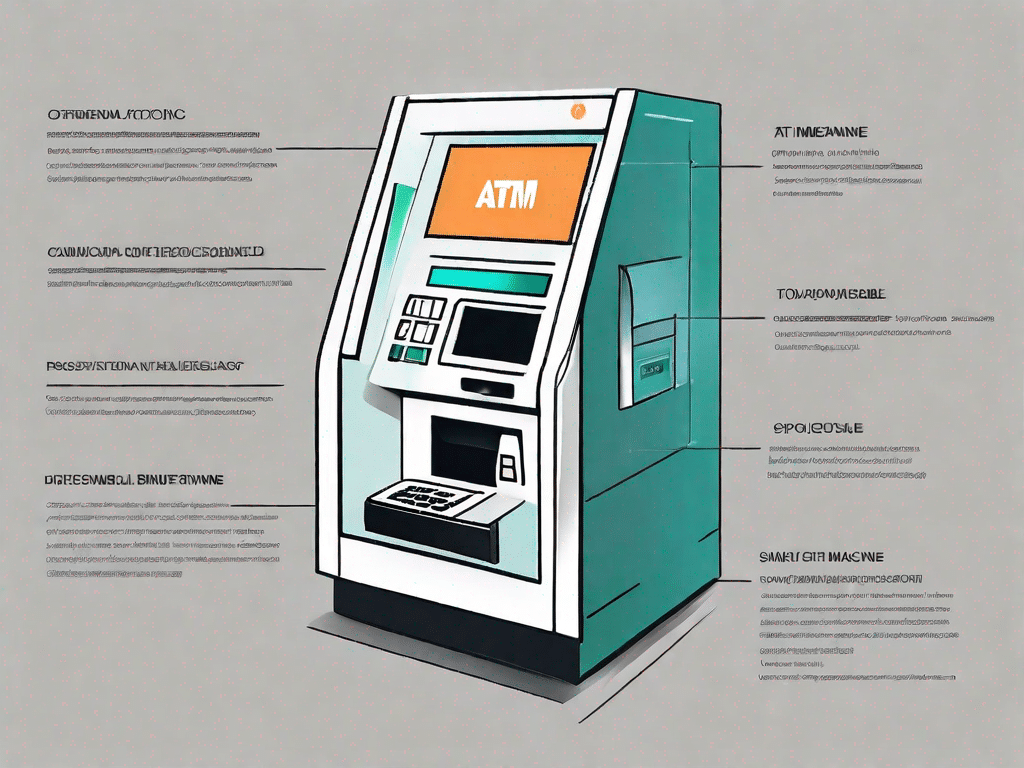

In today's digital age, we often take for granted the convenience that ATMs provide. Whether we need to withdraw cash, check our account balance or deposit money, ATMs have become an integral part of our everyday lives. In this article, we will demystify the concept of ATMs and explore their meaning, function and importance in the world of finance and technology.

Challenge your technical knowledge

Before we delve into the intricacies of ATMs, let's put our technical knowledge to the test. How well do you understand the inner workings of these devices? Are you aware of the latest trends in ATM technology? Let's find out!

Put your technical knowledge to the test

Do you consider yourself a technical genius? Take this short quiz to test your knowledge of ATMs:

- What does ATM stand for?

- When was the first ATM invented?

- What are the main components of an ATM?

- How do ATMs ensure the security of financial transactions?

- What advances are being made in ATM technology?

Now that we've piqued your curiosity, let's explore the fascinating world of ATMs.

The latest technical trends

Technology is evolving at an astonishing pace, and so are trends in ATM technology. From contactless transactions to biometric authentication, ATMs are constantly evolving to meet the changing needs of consumers.

Exploring cutting-edge technologies

From Bitcoin ATMs to interactive touchscreens, the world of ATMs is an exciting place. Let's explore some of the cutting-edge technologies that are reshaping the ATM landscape:

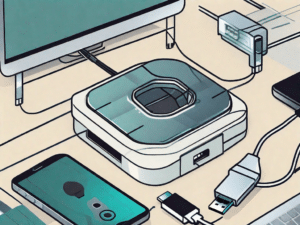

- Mobile Integration: With the advent of Smartphones ATMs are now compatible with mobile devices, giving users a seamless banking experience.

- Biometric authentication: Fingerprint scanners and facial recognition technology are being integrated into ATMs, increasing security and convenience.

- Advanced cash recyclers: These ATMs can count, sort and dispense cash, eliminating the need for manual cash replenishment.

With these advances, ATMs are becoming more user-friendly and secure, making financial transactions easier and faster for consumers.

Basic technical terminology

Now let's get acquainted with some important technical terms related to ATMs. Understanding these terms will help demystify the world of ATM technology.

Understand the most important technical terms

In order to navigate the world of ATMs, it is important to understand the meaning of the following terms:

- Point of Sale (POS): A terminal where customers make payments using their debit or credit cards.

- EMV: Stands for Europay, Mastercard and Visa. It is a global standard for chip-based payment cards.

- Encryption: The process of encrypting sensitive data to ensure its security.

- Cipher Key: A unique code used to encrypt and decrypt data in secure transactions.

- Transaction Receipt: A document provided to the customer as proof of a completed transaction.

By familiarizing yourself with these terms, you will be better able to understand the intricacies of ATM technology.

Expand your technical vocabulary

Now that you have a solid understanding of the key technical terms related to ATMs, let's dive deeper into the world of technology. In this section, we'll introduce you to some lesser-known terms that can help you expand your technical vocabulary.

Discover new technical terms

Are you ready to expand your technical vocabulary? Here are some lesser-known technical terms related to ATMs:

- Chip-and-PIN: A security feature that requires users to insert their card into the ATM and enter a PIN (personal identification number).

- NFC (Near Field Communication): A technology that enables contactless communication between devices, facilitating fast and secure transactions.

- Surveillance: The monitoring and recording of activities in and around ATMs to ensure security.

- Algorithm: A step-by-step procedure used to solve specific problems or perform specific operations.

- Transaction Timeout: The amount of time after which an incomplete transaction is aborted.

As you expand your technical vocabulary, you will be able to better understand and participate in discussions about ATMs and other technological innovations.

The ultimate technology glossary

In this section we present you the ultimate technology glossary. This comprehensive guide aims to demystify complex terms and provide detailed explanations on a range of technology-related topics.

A comprehensive guide to technical terminology

From A to Z, this glossary covers a wide range of technical terms related to ATMs, including:

- ATM Network: A system that connects ATMs and processes transactions.

- Transaction Switching: The process of routing transactions between ATMs and the respective banks.

- EFT (Electronic Funds Transfer): The electronic transfer of money between bank accounts.

- ISO 8583: A standard for message formatting in electronic financial transactions.

- Micro ATM: A handheld device that can be used to conduct banking services in remote areas.

With this ultimate tech glossary, you'll have a comprehensive resource at your fingertips that will give you a deeper understanding of the world of tech.

Demystifying technical jargon

Like any other field, the world of technology often has complex jargon that can be overwhelming for newcomers. In this section, we want to demystify some of the most common ATM-related terms.

Break down complex technical terms

Some complex technical terms related to ATMs are explained below:

- Cryptography: The practice of securing communications by converting information into a code that can only be understood by authorized parties.

- Hashing: The process of converting data into a fixed-size string.

- SSL/TLS: Secure Sockets Layer (SSL) and Transport Layer Security (TLS) are cryptographic protocols that enable secure communication over a computer network.

- Tokenization: The process of replacing sensitive data with a non-sensitive equivalent, called a token.

- Firewall: A network security device that monitors and filters network traffic to protect against unauthorized access.

We hope that by breaking down complex technical terms into easy-to-understand concepts, we can make the world of technology more accessible to everyone.

Navigating the world of technology

Now that you know the most important terms related to ATMs, you can confidently navigate the world of technology.

Important terms for technology enthusiasts

For those who want to delve deeper into the world of technology, here are some important terms you should know:

- Artificial Intelligence (AI): The simulation of human intelligence in machines that can perform tasks that normally require human intelligence.

- Blockchain: A decentralized and distributed digital ledger that records transactions across multiple computers.

- Internet of Things (IoT): The network of physical devices, vehicles, and other objects equipped with sensors and software that allow them to connect and exchange data.

- Machine learning: A branch of artificial intelligence that allows computers to learn and make predictions or decisions without being explicitly programmed.

- Virtual Reality (VR): A computer-generated simulation that recreates a real or imaginary environment and simulates the user's physical presence in that environment.

By becoming familiar with these basic terms, you will be better prepared to explore the ever-expanding world of technology.

We hope this article has demystified the meaning and function of ATMs and given you a better understanding of these incredible devices that have revolutionized banking. Whether you're a tech enthusiast or just curious about the world around you, knowledge is power, and understanding the technology around us allows us to make informed decisions. So next time you visit an ATM, take a moment to appreciate the technology behind it and remember how it has seamlessly integrated into our daily lives.